An article in Bloomberg by Elizabeth Bunn titled “U.S. Insurers Resist Push to Make Gun Owners Get Coverage” has been picked up by various sites on the web. The American Insurance Association, a property-casualty trade association is quoted as saying that gun insurance could have an effect of more gun violence by owners who have less at stake and that “Property and casualty insurance does not and cannot cover gun crimes.” They must be talking about current liability insurance which is written for the benefit of the first party insurance (and gun) owners. They also quote Bob Hartwig president of the Insurance Information Institute as saying “Insurers will not insure illegal acts.”

Insurance which is required for the benefit of third parties injured by some kind of activity often works differently. For example, if in some incident of road rage an insured person intentionally smashes into your car can you collect from his (probably not her) insurance? It varies from state to state. In Texas you can’t, in Massachusetts you can as decided in Cannon v. Commerce Insurance Company, 18 Mass. App. Ct. 984 (1984). In other states there has not been any court decision on the matter and it may depend on the details of language concerning who is an insured party.

In many business situations an intentional act on the part of one insured (often an employee) may create a liability on the part of another insured (the business or corporation itself). Businesses want to protect against such situations and insist that insurers put a “separation of interests” clause in the insurance contract. For an example of a court decision applying that to intentional acts see Minkler v. Safeco Insurance Company of America, (Cal. Sup. Ct., S174016, June 16, 2010). The effect of this is to treat each insured party separately so the the business is insured even if the employee has done an illegal and intentional act which cannot be insured for the employees benefit because of a doctrine of public policy. A more wide ranging example might be a performance bond taken out by a construction company for the benefit of their customer. It protects the customer even if the contractor cheats and steals funds.

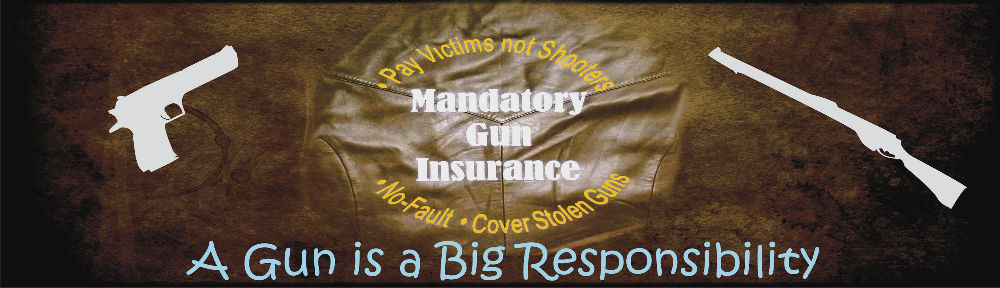

The point is that insurance to protect victims of gun violence can and should be structured for that purpose. The model of first party liability insurance is not very good here. No-Fault insurance is a better model. It’s not necessary to have all the characteristics of No-Fault such as the victim’s insurance(if any) paying first, but that would be OK. The use of a pool to cover unknown or uninsured gun owners is very desirable. The one in use many No-Fault states would work for guns.

The proposed laws in various states, most recently in NY, which would mandate liability insurance as a condition of having a gun license do not give details in the type of insurance required other than “liability” and a specified limit. It’s probably for this reason that the Insurance Industry is not yet taking the possibility of requiring insurance to protect victims of gun violence seriously. The insurance industry has found a way to help with almost any risk in the past, except perhaps for flood insurance which would also be possible if universally mandated. There are many published lists of “Principles of Insurability.” Gun insurance measures up well to them. In particular, a general requirement for such insurance will prevent adverse selection. Bob Hartwig also stated “they can’t require companies to offer that coverage.” Insurance companies require a suitable market and insurance structure to provide coverage. That is quite possible for gun insurance. The insurance industry needs to be a part of designing that structure, so far they have not engaged.